Project Overview

Individual Management Class Case Study (MGMT 314 & MGMT 465)

In this financial case study, I conducted an in-depth analysis of Amazon’s financial statements, assessing its financial health, growth potential, and competitive positioning within the e-commerce and cloud computing sectors. The analysis employed various financial tools, including the Altman Z-Score and free cash flow models, to evaluate Amazon’s profitability, liquidity, and long-term sustainability.

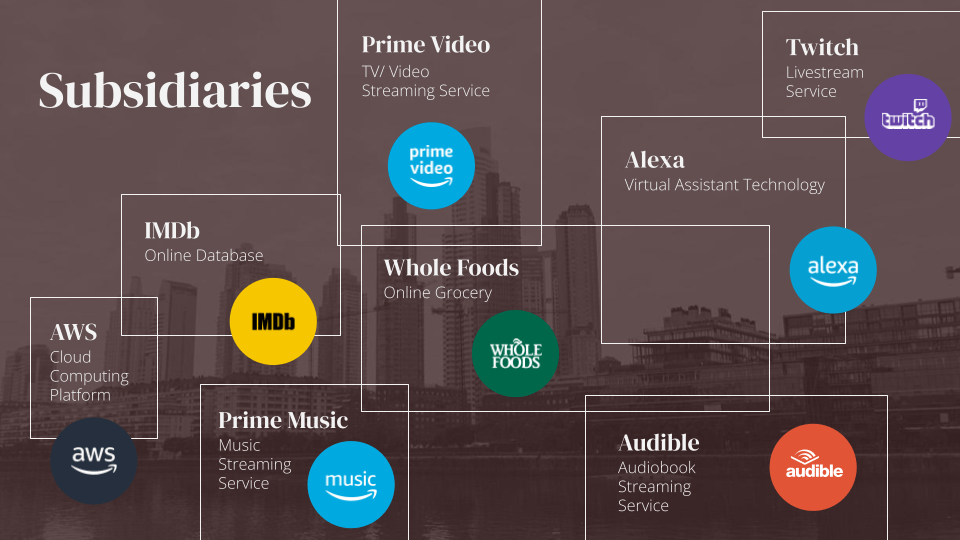

Special attention was given to Amazon’s performance during the COVID-19 pandemic, which underscored the company’s resilience and its ability to innovate across multiple business segments, including not only e-commerce and cloud computing (AWS) but also AI services and logistics. Amidst global economic challenges, Amazon experienced significant surges in demand for online shopping and cloud services.

Overall, this financial analysis not only provided insights into Amazon’s current performance but also outlined potential future trajectories for the company, considering factors such as technological advancements, market competition, and evolving consumer preferences.

Key Skills

- Financial Analysis & Forecasting

- Competitive Benchmarking

- Risk Assessment

- Investment Decision-Making

- Strategic Insights

- Sector Segmentation

- Report Development

- Market Analysis

Role & Responsibilities

In this project, I served as the lead analyst, responsible for collecting and interpreting Amazon’s financial data with a particular emphasis on accuracy and relevance. I meticulously analyzed key financial indicators such as revenue growth, profit margins, and cash flow generation to provide a thorough understanding of the company’s fiscal health.

Additionally, I evaluated Amazon’s capital structure, examining its strategic use of debt versus equity financing to maintain a competitive edge in the rapidly shifting market landscape. To contextualize the company’s financial performance, I conducted a comprehensive comparative analysis with its primary competitors in the e-commerce and cloud computing spaces, offering valuable insights into Amazon’s competitive advantages and positioning. This involved assessing market trends, consumer behavior, and technological advancements that impact the industry as a whole. I compiled this data into a report, which included detailed recommendations for investors based on Amazon’s current and projected financial outlook.

Challenges

Analyzing Amazon’s financials was a complex task due to the company’s sheer size and the wide range of sectors it operates in. A key challenge was breaking down Amazon’s diverse business operations, including its core retail business, cloud services, and growing AI division, each of which contributes significantly to the company’s revenue and strategic direction. Furthermore, the intricate interplay between these segments meant that fluctuations in one area could have ripple effects across others, complicating the overall financial picture.

The core retail business, for example, not only had to contend with traditional brick-and-mortar competition but also with evolving consumer preferences and the rapid shift to online shopping. Meanwhile, cloud services opened up a new realm of opportunities and revenue streams, yet it also required substantial investments in technology and infrastructure. The growing AI division, on the other hand, represented both a forward-looking growth area and a substantial cost center for research and development. Each segment had unique financial drivers, making it difficult to assess the company’s overall performance without a deep-dive.

Additionally, Amazon’s rapid growth and expansion into new markets presented challenges in predicting its long-term financial trajectory, particularly as new competitors emerged and regulatory scrutiny increased. The complexity of these intertwined factors necessitated a meticulous approach to financial analysis, requiring experts to sift through volumes of data and projections to ascertain a clearer picture of Amazon’s financial health and future prospects.

Actions Taken

I employed a sector-specific approach, analyzing Amazon’s financials on both a consolidated and segmented basis to gain a thorough understanding of its operations. By examining each business unit individually, I was able to provide a clearer picture of the company’s profitability drivers and risk factors, which allowed for a comprehensive assessment of its competitive positioning in the market.

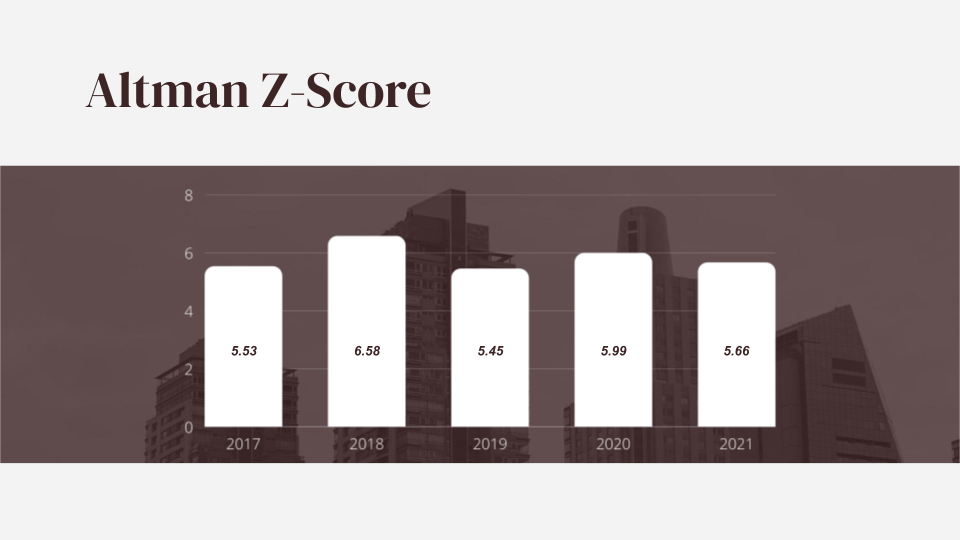

I utilized the Altman Z-Score to rigorously assess Amazon’s risk of bankruptcy, ensuring a detailed evaluation of its financial health, alongside implementing free cash flow models to meticulously evaluate its ability to generate future profits and sustain growth in a dynamic market environment. Furthermore, I conducted an extensive environmental, social, and governance (ESG) risk assessment to understand how external factors like regulatory pressures and sustainability initiatives could impact Amazon’s long-term performance.

This multidimensional analysis not only highlighted the risks inherent in Amazon’s business model but also illuminated potential opportunities for enhancing its resilience and adaptability in an ever-evolving landscape, paving the way for informed strategic decisions moving forward.

Results

The financial analysis highlighted Amazon’s strong liquidity position and ability to generate consistent free cash flow, even during economic downturns, which underscores its resilience in challenging market conditions. I recommended a “Buy” rating for investors, citing Amazon’s dominance in cloud computing, where it continues to capture significant market share and deliver robust growth rates, rapid advancements in artificial intelligence that position the company at the forefront of technological innovation, and ongoing evolution and continuous innovation in e-commerce, which are all seen as key drivers of future success and sustainability.

Furthermore, the report also underscored the company’s relatively low financial risk, as demonstrated by its strong Altman Z-Score and solid debt management practices that reassure stakeholders of its financial stability. This strategic positioning not only enhances investor confidence but also enables the company to capitalize on emerging opportunities in various sectors, reinforcing its competitive edge and long-term growth potential.

Leave a comment